Zoning ordinances are fundamental to urban planning, dictating land use through classifications like residential, commercial, industrial, and mixed-use. These regulations impact property purchases, renovations, and financing options, with changes affecting local real estate markets significantly. Compliance goes beyond legal adherence, promoting harmonious development and considering community goals. Understanding zoning categories is crucial for investors and developers, influencing borrower requirements, construction plans, and investment returns. The appeals process allows challenges to regulatory decisions, while future trends include mixed-use strategies, data-driven planning, inclusive practices, and sustainability initiatives.

Understanding zoning ordinances is essential for any consumer looking to navigate the complexities of property development and land use. These regulations, which dictate how land can be used and what structures can be built, play a crucial role in shaping urban landscapes and community growth. However, their intricate nature often leaves many consumers confused and overwhelmed. This article aims to demystify zoning ordinances, providing an authoritative guide that breaks down their key components and offers practical insights for informed decision-making. By the end, readers will possess the knowledge to confidently engage with these vital rules governing our built environment.

Understanding Zoning Ordinance Basics

Zoning ordinances are a crucial aspect of urban planning and development, shaping the way communities grow and evolve. At their core, these regulations dictate how land can be used, ensuring that neighborhoods remain safe, vibrant, and organized. Understanding zoning ordinance basics is essential for both property owners and borrowers as it influences decisions regarding property purchases, renovations, and future developments.

The primary purpose of a zoning ordinance is to classify lands into specific zones, each with its own permitted uses. These zones can include residential, commercial, industrial, or mixed-use districts. Within each zone, there are usually detailed regulations covering building sizes, densities, setbacks, and other factors. For instance, in a residential area, the ordinance might specify lot size requirements, maximum building height, and allowed types of structures. Borrowers should be aware that these restrictions can impact their financing options and loan-to-value ratios, especially when seeking construction or development loans. Zoning ordinance borrower requirements often involve demonstrating compliance with local regulations to secure funding for projects that fall within permitted uses.

Compliance with zoning ordinances is not just about legal adherence; it also ensures a harmonious blend of land uses. For example, mixing residential and commercial zones can promote walkability and reduce commute times. However, proper planning is vital to avoid negative impacts on neighbors and the broader community. Property owners or borrowers looking to renovate or develop land should conduct thorough research to understand the specific zoning classification and associated rules. This may involve consulting with local authorities, architects, and lenders who have expertise in navigating zoning ordinance borrower requirements. By doing so, individuals can ensure their projects align not only with legal standards but also with the community’s vision for growth.

How Zoning Affects Property Values

The zoning ordinance, a cornerstone of urban planning, significantly influences property values, often in subtle yet profound ways. This regulatory framework divides municipalities into distinct zones, each with specific land use designations, aiming to balance residential, commercial, and industrial activities. Changes in the zoning ordinance borrower requirements can trigger a domino effect on local real estate markets. For instance, a shift that allows mixed-use development can enhance property values by introducing a broader range of amenities within walking distance, thereby appealing to a more diverse demographic.

When a zoning ordinance is updated to accommodate higher density housing or commercial uses, areas previously considered less desirable may experience a surge in value. This dynamic is evident in cities where revitalized industrial districts, once characterized by empty warehouses, transform into vibrant mixed-use communities, attracting young professionals and driving up property prices. Conversely, strict zoning regulations that limit development can preserve certain neighborhoods’ character but potentially cap property values, as seen in historic districts where careful preservation requirements maintain low density and unique architectural styles.

Lenders and borrowers alike must consider the zoning ordinance borrower requirements when assessing property investments. Understanding how local zoning laws impact an area’s growth potential is crucial for predicting market trends and ensuring loans are secured against assets with sustainable long-term value. By staying informed about zoning changes, borrowers can make informed decisions, while lenders benefit from providing financing options that align with the evolving real estate landscape, fostering a mutually beneficial relationship built on shared expertise and understanding of the zoning ordinance’s role in shaping property values.

Navigating Zoning Laws for Construction

Navigating zoning laws is a crucial step for anyone planning construction projects, especially borrowers seeking to secure funding. Zoning ordinances, designed to regulate land use and development, vary widely across jurisdictions, demanding a deep understanding from both builders and lenders. These ordinances dictate building purposes, sizes, setbacks, and even the types of structures permitted in specific areas, influencing everything from residential developments to commercial projects.

For borrowers, complying with local zoning ordinance borrower requirements is essential for securing financing. Lenders will assess whether proposed construction aligns with the zone’s established parameters, ensuring investments are made responsibly within legal boundaries. For instance, a property zoned for single-family residences typically restricts multi-family or commercial usage, even if the borrower intends to build an assisted living facility. Understanding these nuances is vital to avoid costly missteps and delays.

Experts advise borrowers to conduct thorough research and consult with professionals early in the process. Local zoning boards often provide detailed ordinances and application guidelines online, offering a starting point for evaluation. Additionally, engaging architectural and engineering firms familiar with local regulations can streamline the design phase and application process. For example, in densely populated areas, strict building codes and density limits may apply, necessitating creative solutions to maximize space while adhering to zoning ordinance borrower requirements.

By proactively engaging with these regulations and seeking expert guidance, borrowers can navigate the complexities of zoning laws successfully. This approach not only ensures compliance but also paves the way for smoother construction projects, ultimately leading to better outcomes and reduced financial risks.

Common Zoning Categories Explained

Zoning ordinances are local laws designed to regulate land use and development within a community. They play a critical role in shaping urban environments, ensuring that neighborhoods maintain their character and that new developments align with existing infrastructure and community needs. Understanding these zoning categories is essential for anyone considering property investment or construction projects, as it significantly impacts borrower requirements and project feasibility.

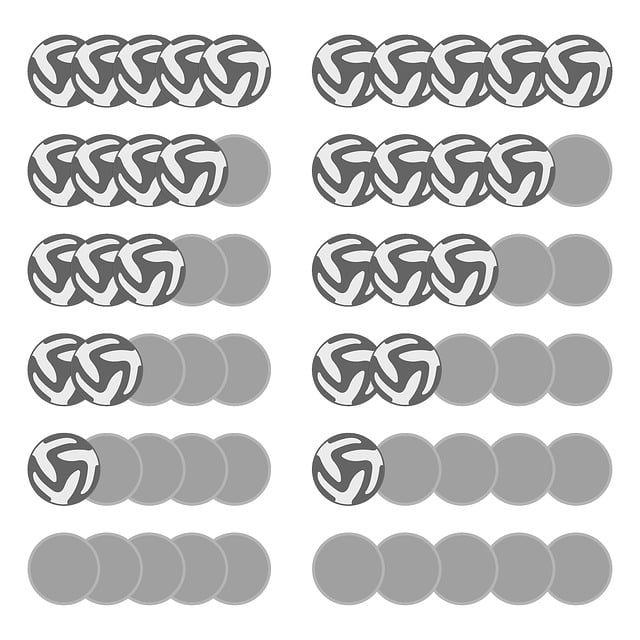

Common zoning classifications include residential, commercial, industrial, and mixed-use districts. Residential zones are primarily designed to accommodate single-family homes or apartments, setting parameters around density, lot sizes, and permitted uses. For instance, a zone might specify that only two-story structures with a minimum lot depth of 50 feet are allowed, ensuring a certain level of privacy and amenity for residents. Commercial areas, on the other hand, facilitate business activities, with regulations tailored to support retail, office, or service industries. These zones often encourage higher densities and allow for multi-level buildings to accommodate the needs of businesses and their customers.

Industrial zoning is dedicated to manufacturing, warehousing, and related activities, reflecting the need for ample space and specific infrastructure. Mixed-use districts combine residential, commercial, and sometimes industrial components within a single area, promoting vibrant, walkable communities. These zones often have flexible regulations to accommodate diverse land uses, fostering a sense of community and accessibility. For borrowers and developers, understanding these categories is paramount as it directly affects financing requirements, construction plans, and potential returns on investment. By adhering to local zoning ordinances, projects can ensure compliance, streamline permitting processes, and ultimately contribute to the sustainable growth of communities.

Appeals Process: Challenging Zoning Decisions

The appeals process plays a critical role within the broader framework of zoning ordinances, offering property owners and developers a mechanism to challenge decisions made by local authorities. This procedure is particularly relevant when borrowers or potential investors find themselves at odds with existing zoning regulations, seeking adjustments to accommodate their intended use of a property. Understanding this process is essential for navigating the complexities of zoning ordinance borrower requirements effectively.

Challenging a zoning decision involves several structured steps, ensuring fairness and providing an avenue for resolving disputes. Typically, a written appeal or petition is filed with the appropriate local government body, setting out the grounds for disagreement. These grounds may include allegations of regulatory overreach, inaccuracies in the initial assessment, or a lack of consideration for extenuating circumstances. For instance, a borrower might dispute a decision that denies their application to rezone land for residential development, arguing that the current agricultural zoning does not align with the surrounding area’s established uses.

Upon receipt of an appeal, the local authority is required to conduct a thorough review, often involving public hearings where both sides present their cases. This process encourages transparency and accountability, ensuring that decisions are made based on comprehensive analysis. During these hearings, borrowers or appellants can offer new evidence, address concerns raised during initial considerations, and advocate for their desired outcome. The decision-makers then deliberate and issue a ruling, either upholding or modifying the original zoning determination. In some cases, an appeal may lead to successful revisions in the zoning ordinance borrower requirements, reflecting the evolving needs of a community and its residents.

The Future of Zoning: Trends and Innovations

As we look to the future of urban development, the role of zoning ordinances is undergoing a significant evolution. Traditional zoning laws, once designed to separate uses like residential, commercial, and industrial areas, are now being re-imagined to accommodate the changing needs of modern societies. One prominent trend is the rise of mixed-use zoning, which encourages the blending of various land uses within a single neighborhood. This approach not only reduces urban sprawl but also fosters vibrant communities by facilitating easier access to amenities, reducing commute times, and promoting walkability. For instance, a growing number of cities are adopting mixed-use developments that seamlessly integrate apartments, retail spaces, and offices, enhancing the quality of life for residents.

The future of zoning ordinance borrower requirements is also set to be influenced by technological advancements. Smart cities, equipped with digital infrastructure, will enable more dynamic and data-driven decision-making processes related to land use planning. Zoning regulations can become more adaptable, reflecting real-time changes in population density, traffic patterns, and environmental factors. Additionally, the integration of remote sensing technologies and geographic information systems (GIS) can provide detailed spatial analyses, helping local governments make informed choices about zoning adjustments. This data-centric approach ensures that zoning ordinances remain relevant and effective while keeping pace with urban growth.

Another innovation is the concept of inclusive zoning practices, which aims to address historical inequities in land use planning. By proactively considering the needs and preferences of diverse communities, policymakers can create zoning regulations that promote affordable housing, support local businesses, and preserve cultural heritage. For example, implementing specific requirements for mixed-income developments or designating areas for community-focused amenities like parks and healthcare facilities can contribute to more equitable urban environments. Engaging with stakeholders through transparent processes is crucial in this context, ensuring that the evolving zoning ordinance borrower requirements reflect the values and aspirations of all residents.

Furthermore, sustainability is emerging as a key driver in shaping future zoning ordinances. Many cities are adopting green building codes and energy-efficient standards to reduce their carbon footprint. Zoning laws can incentivize sustainable practices by allowing for taller buildings with more floor space, provided they meet stringent environmental criteria. This approach not only conserves land but also encourages developers to embrace innovative construction methods and materials. As the global emphasis on combating climate change intensifies, zoning ordinance borrower requirements will play a pivotal role in guiding urban development towards more eco-friendly outcomes.